Exceptional growth in private investment in information processing equipment and in software has accounted for all of GDP growth in the first half of 2025. The BEA released on August 28 its second estimate for GDP growth in the second quarter of this year, and most commentary focused on the upward revision in overall GDP growth in the second quarter from 3.0% (at an annual rate) in its advance estimate released last month to 3.3% now. But what I believe is of more interest is that all of the growth so far this year has come from private investment in new information processing equipment and software: i.e. from the AI investment boom.

As we are all taught in Econ 101, the nation’s GDP is equal to what is spent during the period for private consumption, for private investment, for government consumption and investment, and for net exports (exports less imports). One should keep in mind that GDP is a measure of what is produced domestically during the period in gross terms (i.e. before depreciation) – hence the name Gross Domestic Product. But since any change in inventories is included within private investment, one can measure what was produced by how it was used (with inventory accumulation as one use; see this earlier post on this blog). Furthermore, we know from Keynes that in a modern economy, the primary driver of production (up to some capacity limit) comes from demand, i.e. from these demand-side components of overall GDP.

From this, one can calculate how much of the growth in GDP was driven by each of the demand-side components. The change in overall GDP in dollar terms from one period to the next will, by definition, equal the sum of the change in each of the demand-side expenditure items in dollar terms. It is of most interest to calculate these in terms of constant prices, and with this then expressed as a percentage of GDP in the prior period, to arrive at an accounting of the contribution of each of the demand components to the growth in GDP in the period.

Furthermore, the demand-side components of GDP are not simply the total levels of private consumption, private investment, and so on. Those aggregate components of GDP can be broken down into individual types of products that add up to the aggregates. That is, the personal consumption component of GDP can be broken down into consumption of goods and consumption of services, consumption of goods can be further broken down into durable goods and nondurable goods, and durable goods further broken down into types of durable goods, etc.

The BEA provides such figures on the contribution to GDP growth from each of the demand-side components in the online Table 1.5.2 of the NIPA (National Income and Product) tables, which it updates whenever it issues a new set of GDP estimates. The table provides figures on how much of the growth in overall GDP from the prior period is accounted for by the growth (in percentage points) in the demand-side components of GDP. The contributions will sum to the increase in percent in overall GDP relative to the prior period.

One can also calculate the contribution figures directly, using Table 1.5.6 of the BEA’s NIPA accounts, which shows – in constant prices – GDP and its demand-side components at the same level of detail as in Table 1.5.2, for each period whether quarterly or annually. One needs to use the figures in this table when calculating the contributions to the growth in GDP relative to a period other than the prior one (and was used here to compare the growth in GDP in the first half of 2025, i.e. between the last quarter of 2024 and the second quarter of 2025).

Of interest to us here is that two of the line items in these detailed GDP accounts are the contribution to the growth in GDP from private fixed investment in information processing equipment and from private fixed investment in software. One can then calculate how much of the growth in GDP can be accounted for by these two components, and then what GDP growth would have been from everything else.

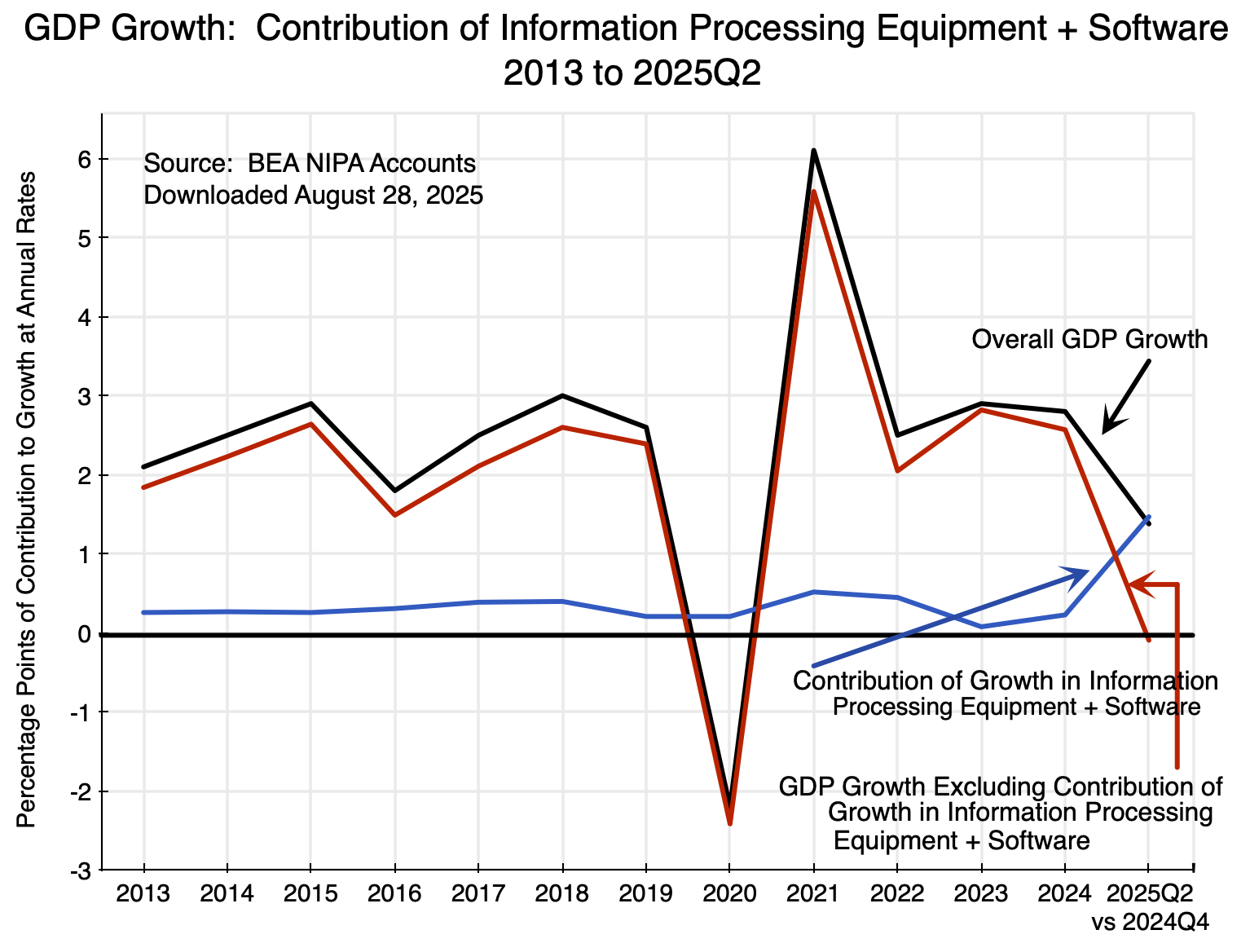

The chart above shows this using annual data from 2013 through 2024 (to provide context), and then for the first half of 2025. The annual figures for 2013 through 2024 came directly from Table 1.5.6 of the NIPA accounts, and show the growth in each year relative to the prior year in overall GDP (the line in black) and then the contribution to that growth that came from private investment in information processing equipment and in software (the line in blue) and the contribution of everything else in the economy (the line in red).

Up through 2024, the contribution to the growth in GDP from private investment in information processing equipment and software was always small – averaging only 0.3% points to the growth in GDP in each period. This is not surprising. While a dynamic component of demand (it grew at an average rate of 7.8% per annum from 2013 to 2024, while overall GDP grew at an average rate of 2.4%), private investment in information processing equipment and software was only 4.1% of GDP in 2024 – a small component of GDP. Thus the growth of everything on the demand side of GDP other than private investment in information processing equipment and software (the line in red) is always close to overall GDP growth up through 2024. That is, it accounted for almost all of GDP growth over the period, as one would expect.

This then changed dramatically in the first half of 2025. Comparing GDP in the second quarter of 2025 to what it was in the last quarter of 2024 (i.e. in the first half year of the new Trump term in office), overall GDP growth fell to just 1.4% at an annual rate. GDP growth had been 2.8% in 2024 in the last year of the Biden presidency (and 6.1%, 2.5%, and 2.9% in 2021 to 2023 respectively), before this fall in the first half of 2025.

But more interesting is that all of the growth in GDP in the first half of 2025 (i.e. in what GDP had grown to as of the second quarter compared to what it was in the last quarter of 2024) came from growth in private investment in information processing equipment and software. The growth of everything else in GDP was in fact slightly negative, and by itself would have led to a 0.1% fall in GDP over the period. Growth in private investment in information processing equipment and software contributed a positive 1.5% points to GDP growth, with the two together thus leading to the 1.4% growth in GDP over the period (all at annual rates).

Private investment in information processing equipment and software by itself grew at an astounding annualized rate of 28.3% over the first half of 2025. This is the AI boom that is underway. Without it, GDP in the second quarter of 2025 would be below where it was in the last quarter of 2024.

Or put another way, all of the growth in GDP so far in 2025 was due to (and absorbed by) the growth in private investment in information processing equipment and software. On a net basis, everything else was stagnant and indeed fell slightly.

You must be logged in to post a comment.