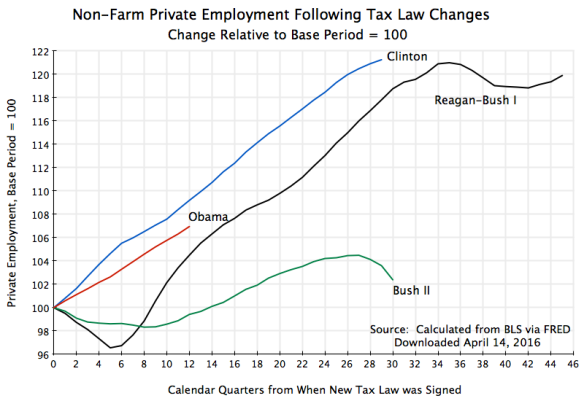

June 20, 2016: This is a slightly revised version of the original post, where the blue curve on the chart above has now been drawn to show solely the impact of productivity growth, rather than productivity growth and net import growth combined. This is simply for clarity, and the points made all remain the same. There was then minor editing of the text to reflect this new presentation.

Summarizing the main result: Productivity growth over the period 1967 to 2014 was almost 19 times more important to the number of jobs in the auto sector in 2014 than would have been the case had net imports somehow been driven to zero.

A. Introduction

It has been repeatedly said in the current US presidential campaign that the various free trade agreements the US has signed in recent decades have led to a decimation of jobs in manufacturing. And it has been largely left unchallenged. The assertion has come not only from Donald Trump on the right (the expected Republican nominee, as the other candidates have dropped out), but also from Senator Bernie Sanders on the left. And it has been made so often, and without a response from others, that many might well believe it to be true. It is presented as something obvious and spoken of as “everyone knows …”.

But it is not true. First of all, the assertion itself is confused on many levels. If it were true that never negotiating a free trade agreement would have led to millions of more jobs than would have been the case without the trade agreements, who would have filled those jobs if the economy is at, or close to, full employment? Second, the whole point of trading is that there will be shifts across sectors. There may be a decline in production in a sector where imports will rise, but there will then also be a rise in production in a sector where exports will grow. While this might not be fully off-setting, to leave out any such offset is a mistake.

But if one ignores such higher level issues, what might have happened to jobs in just one sector if imports were somehow cut off by raising trade barriers? The prime example most often cited is the US auto industry. This blog post will look at what has in fact happened to jobs in the sector in recent decades, what the impact would have been had there been no imports, and what happened as a result of productivity growth.

The bottom line is that even under generous assumptions of what would have happened if imports had been restricted, such cuts in imports would not have had a very big impact on jobs in the sector. Rather, jobs in the auto industry have been largely flat over the past half century not because of imports, but because productivity has increased. And productivity growth is a good thing.

B. Jobs in the US Motor Vehicle Sector, and the Impact of Imports

The chart at the top of this post shows (as the curve in black) what has happened to US jobs in the motor vehicle sector since 1967. The data comes from the US Bureau of Economic Analysis, as part of its National Income and Product Accounts (NIPA), and covers the period from 1967 (the first year in this data series) to 2014 (the most recent year with job figures). “Jobs” are defined as the number of persons engaged in production in the sector, counted in terms of full time equivalent employees and including any self-employed in the sector. The sector is Motor Vehicles, and includes vehicle bodies, trailers, and parts.

The number of jobs in the sector was largely flat over much of the period, fluctuating generally in the range of 0.9 to 1.3 million, but somewhat less over the last decade (a consequence of the 2008 collapse of the economy and then slow recovery). The number of jobs in the sector fell from 1,057,000 in 1967 to 872,000 in 2014, a fall of 17%.

[Technical note on the jobs data: The BEA changed its categorization of jobs in this sector in 2000, and only provided overlapping data for the three years 1998 to 2000 for both the new and old definitions. For the period prior to 1998, I rescaled the jobs figures to reflect the average proportional change shown in the 1998 to 2000 figures. Strictly speaking, the earlier data is not directly comparable to the figures from 1998 onwards, but for the purposes here, the approximation is adequate.]

What would the number of jobs have been had imports been cut off? While many things would likely change as a result of policy measures that somehow ended all imports (and would depend on precisely what measures were taken), a generous set of assumptions to make would be that all that was previously imported would now be made domestically, and that despite what would likely be higher costs, total sales from the sector would nonetheless remain unchanged. We will make those assumptions, and also assume that average productivity would remain unchanged. And imports will be measured by net imports, i.e. gross imports minus gross exports of the sector, as cutting off all imports would likely lead to exports from the sector being similarly cut.

Under such assumptions, the number of jobs in the sector would be as shown in the red curve on the chart at the top of this post. By construction, there would be more jobs in the sector, as sales and productivity would be unchanged but all the production would now be domestic. But not only would the result be a relatively modest increase in jobs in any given year, the absolute number of jobs would also be flat over the period as a whole. The number of jobs in the sector would be 1.1 million after rounding in 1967 and still 1.1 million in 2014 (although with fluctuations in the intervening years).

Cutting off imports would not have led to a big growth in jobs in the auto sector over this period. It would not even have led to a modest growth over the period as a whole.

C. The Impact of Productivity Growth

If not imports, why then has employment in the sector largely been unchanged for most of this close to half century, and indeed declined by 17% from the start to end points? Output grew by a lot. Motor vehicle sector domestic output in 2014 was 4.5 times higher than what it was in 1967 (in real terms). Yet employment was less.

The reason, of course, is productivity growth. One needs far fewer workers now to build a car than what was needed in 1967. There has been widespread growth in the use of robotics to substitute for many in the traditional production line, as well as other measures to reduce the number of workers needed to make each car. The result is that output per worker (productivity) was 5.4 times higher in 2014 than what it was in 1967 (in real terms), based on the BEA figures. Hence the number of workers needed and employed fell from the 1,057,000 in 1967 to 872,000 in 2014 (the same ratio, within roundoff, as the ratio of 5.4 to 4.5).

What if this productivity growth had not occurred? If costs and sales had remained the same as otherwise (not likely, but assume that for the purposes here), one would then have needed a sharp increase in the number of workers to produce in 2014 what could be produced with the productivity of 1967. The number of workers that would then have been needed is shown as the blue curve (the top one) in the chart above.

With no productivity growth, but all else the same as otherwise, one would have had to employ far more workers in the sector to produce the autos and other motor vehicles sold. Put another way, the reason there has been no growth in the number of jobs in the sector over the last half century is not because of imports, but because of productivity growth. The impact of imports, even under generous assumptions, has been minor in comparison.

And productivity growth is a good thing, not a bad. For real incomes to improve, productivity must go up, not stagnate. There are, however and most certainly, important issues with how the gains to that productivity growth is being distributed. As earlier posts on this blog have discussed, median real wages have been basically stagnant since around 1980, and the gains to growth since around 1980 have gone fully to the extremely rich.

What might be done about this maldistribution of the gains to productivity growth is an extremely important, but separate, issue. That is where the policy debate should focus. A set of measures that might be taken to address the sharp increase in inequality in the decades since Reagan was president was discussed in this earlier post on this blog. Limiting imports is not one of them. The most important measure for the issues here would be active fiscal policy to keep the demand for labor at close to full employment levels. Only then will labor have the bargaining power needed to ensure wages rise in line with productivity growth.

D. Conclusion

Free trade agreements signed by the US in recent decades have been harshly criticized in this year’s presidential campaign, by candidates both on the right (Donald Trump) and on the left (Bernie Sanders). They take as a given that the agreements have led to a huge loss of jobs in the sectors where trade is possible. But that is simply not the case. The auto sector is often taken as the pre-eminent example of how American industry has been harmed by exposure to competition from imports. But as discussed above, even under extreme assumptions on what would follow if imports were cut off, the impact on jobs would be small. Rather, the reason there are not more jobs in the sector now than there were in 1967 is because the productivity per worker is now much higher. And higher productivity is a good thing.

This is not to say that there are are no possible issues with the trade agreements. There are. But the concern I have is not with measures that move towards free (or at least freer) trade, but rather with measures that will do the opposite. For example, a problem with the Trans-Pacific Partnership (negotiated between the US and 11 other Pacific rim countries, but which is still to be ratified or not by Congress), is the provision that would extend the patent protection enjoyed by US pharmaceutical companies to the 11 other countries, thus constraining their access to generic drugs. This is the creation of a trade impediment, not a move towards freer trade.

But it is incorrect to blame the free trade agreements signed in recent decades for the lack of job growth in sectors such as autos. Jobs in that sector have been flat or declining because worker productivity is now much higher than it was before. One needs fewer workers to make each car. There are certainly issues, extremely important issues, with how the gains to that productivity growth have been distributed, but restricting imports would not address them.

You must be logged in to post a comment.