Chart 1

A. Introduction

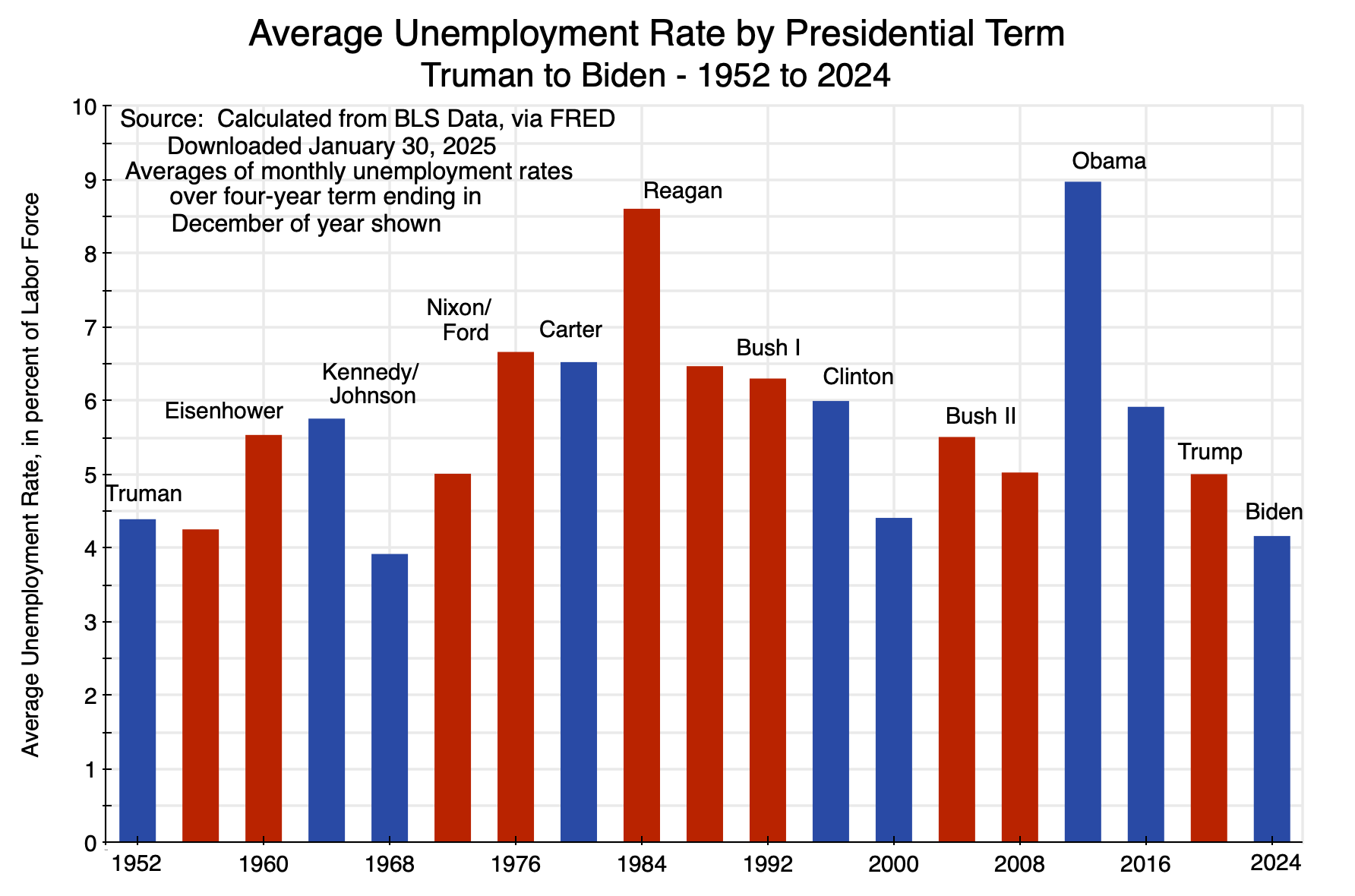

Trump has undermined what had been a strong US economy more quickly than most expected. The BEA released on April 30 its initial estimate (what it labels the “advance estimate”) of the growth in GDP in the first quarter of 2025. The economy contracted by 0.3% at an annual rate. Real GDP grew at solid – indeed excellent – rates while Biden was in office. The economy grew by 6.1% in 2021 as it emerged from the Covid crisis – faster than in any year since 1984 – and by 2.5% in 2022. It then grew at a rate of 2.9% in 2023 and 2.8% in 2024. While the GDP estimate for the first quarter of 2025 will be revised as additional data becomes available in the coming months, this is a terrible start for the new administration.

The cause of this fall in GDP in the first quarter of the Trump administration has been misinterpreted by many. Prominent among them was Peter Navarro, the primary trade advisor in the White House. In an interview on CNBC, Navarro asserted:

“when you strip out inventories and the negative effects of the surge in imports because of the tariffs, you had 3% growth.”

No: Output did not grow. It fell at a 0.3% rate. There was indeed an extraordinary surge in imports. Trump began to impose major tariffs on imports soon after taking office, with a promise of far higher rates to come. And indeed, on April 2 he announced extraordinarily high (and highly variable) tariff rates on every “country” in the world (including one occupied only by penguins), only to back down on April 9, saying they would be postponed for 90 days. In anticipation of what might come, imports of goods and services rose in the first quarter of 2025 at an astounding 41% annualized rate and imports of goods only (which can be stored) rose at a 51% rate.

But an increase in imports does not – in itself – affect the calculation of GDP. GDP is a measure of domestic production (that is what the D stands for in GDP: Gross Domestic Product). Domestic production is what it is in the accounting regardless of how much is imported.

The confusion of Navarro and many in the news media stems from the formula that all are taught in an introductory Econ 101 macroeconomics class:

GDP = Consumption + Fixed Investment + Investment in Inventories + Exports – Imports

(where government consumption and investment can be combined with private consumption and investment, which we will do here for simplicity). Imports are subtracted out at the end of this formula because Consumption, Fixed Investment, Investment in Inventories, and Exports all include the imports that help supply (directly or indirectly) these components of demand. That is, Consumption (for example) includes consumption of domestic production as well as consumption of whatever is imported and used for that purpose. And similarly for the other demand components. Total Imports must then be subtracted out (as it is at the end of the formula) to arrive at what domestic production was. That domestic production is GDP.

While it is easy to see why there would be such a mistake in the interpretation of how GDP is determined, there is no excuse for policy officials as well as journalists who write on economic issues to make such a mistake.

I have discussed before on this blog how GDP is estimated (see here and here). But given this widespread misinterpretation of the 2025Q1 figures, it is worth reviewing the issue again. That will be covered in the first section below. The section that follows will then discuss the new GDP estimates themselves, and what those figures are telling us about how the economy has responded to the new Trump administration. This concrete example will also help to reinforce the understanding on how imports enter.

The concluding section will then briefly look at what is in prospect for the GDP figures, both in the coming months and beyond. While the economy is probably not yet in a recession, the policies of the new Trump administration (and its chaotic implementation) make it increasingly clear that the US will soon enter into a recession, unless Trump quickly reverses what he is doing. And there is little likelihood of Trump doing that.

B. Econ 101: What GDP Means and How it is Estimated

Numerous news sources (as well as the official White House press release) misinterpreted the impact of imports on the GDP estimate for the first quarter of 2025. As one example among many, the CNBC report on the GDP figures stated:

“Imports subtract from GDP, so the contraction in growth may not be viewed as negatively given the potential for the trend to reverse in subsequent quarters. Imports took more than 5 percentage points off the headline reading.”

Which is wrong.

GDP is an acronym for Gross Domestic Product. “Product” means what is produced; “Domestic” means what is domestically produced; and “Gross” refers to the gross level of investment being counted rather than investment net of an estimate of depreciation (the latter measure of investment would then lead to Net Domestic Product, or NDP).

So how is GDP estimated? As was discussed in the earlier blog posts referred to above, the BEA (the government agency that produces the GDP accounts) does this in three different ways. In principle, all three should lead to the same estimate for GDP. Because they are all estimates based on surveys and other statistics, they don’t although they should be close. There will always be statistical noise, and the three different estimates serve as a good check on each other to help find whether a mistake was made somewhere.

One approach is to estimate domestic production directly – sector by sector. However, data for this is the most difficult to come by, and the first BEA estimate of GDP by this method is only provided three months after the end of a calendar quarter, i.e. in late June for the January to March quarter. A second approach is to estimate domestic production by the incomes generated. Since whatever is produced and sold will be reflected in incomes (in the wages of the workers employed, and then in the profits that remain following the payments for all the inputs used in production plus the wages paid), this should in principle also sum to GDP. The BEA provides its first estimate of GDP using this approach (which, to limit confusion, it labels Gross Domestic Income, or GDI) two months after the end of a calendar quarter, i.e. in late May for the January to March quarter.

The third approach – and the one most commonly considered when GDP is referred to – is to estimate GDP from the uses of whatever is produced. Whatever is produced is used, and if those uses can be estimated, this can be used to arrive at an estimate of what is produced, i.e. GDP. The BEA can also provide a reasonable estimate of GDP this way relatively quickly after the end of each calendar quarter. It issues its initial estimate one month after the end of each calendar quarter, i.e. in late April for the January to March quarter. While the estimate will be revised as more data become available in the subsequent months, it is this estimate of GDP that receives the most attention as it is the first to be released. Keeping track of the various demands for production is also important in a modern economy since we know from Keynes that production (up to a limit set by full employment) will largely follow from what the demands are.

This estimate is also built around the well-known equation referred to in the introduction above. Starting with the simplest form in order to make clear that GDP is a measure of domestic production and not of demand, consider an economy where there is no foreign trade. The equation is then:

GDP = Consumption + Fixed Investment + Investment in Inventories

The final uses of (the final demands for) goods and services are that they are either consumed or invested. But what is consumed or invested in a period will normally differ from what is produced. The simple trick, then, is to include along with the final demands the amount that is added to inventories (if production exceeds the sum of the final demands in the period) or taken out of inventories (if production falls short of the sum of the final demands in the period). Hence by adding the net change in inventories (inventory accumulation, which is an investment) to the final demands for goods and services, one will arrive at what was produced in that period. (Note that the terms “additions to inventories”, “investment in inventories”, and “accumulation of inventories” all refer to the same thing and are used interchangeably.)

Simple, although it can easily lead to the mistake of treating the demand for goods and services as GDP, when GDP is in fact the production of goods and services.

We can add foreign trade in goods and services to this. There will be exports (also a final demand for goods and services) as well as imports. Imports are an additional source of supply of goods and services that add to what is domestically produced. Putting the supply of goods and services on the left and the demand for goods and services on the right, one has:

Supply of goods and services = Demand for goods and services

GDP + Imports = Consumption + Fixed Investment + Investment in Inventories + Exports

The supplies of goods and services – whether from domestic production (GDP) or foreign production (Imports) – are used to meet the final demands for Consumption, Investment, and Exports, along with any accumulation of inventories if the total supplied exceeds the final demands (or decumulation of inventories if final demands exceed supplies).

Moving Imports to the right side of the equation, one then has the well-known:

GDP = Consumption + Fixed Investment + Investment in Inventories + Exports – Imports

It is important to keep in mind that imports typically enter indirectly, as an input to what is being produced and thus enabling a greater overall supply. But one cannot map what share of Consumption, say, came from domestic supply and how much from foreign supply. Imports are a resource that enables the nation to provide more. How can one know, for example, whether a gallon of fuel, say, that was imported was used to help produce an item for consumption, or an item for investment, or an item for exports, or was added to inventories? And even if the imported item can be individually identified, the complex nature of multi-level production (where intermediate goods produced can be used for a variety of different final goods) often makes it impossible to trace what an imported item ended up being used for.

As a result, the BEA cannot produce individual estimates of how much of Consumption, say, came from domestically supplied items and how much came from items produced with imports as a resource. All it can provide are estimates of each of the demand components (including any addition to – or subtraction from – inventories), and then subtract total imports from the total demands to arrive at an estimate of what domestic production (GDP) was.

Imports in this accounting thus do not subtract from GDP, even though numerous news sources (and Trump officials) asserted precisely that. If imports had been $1 billion higher, say, then there would have been $1 billion more in Consumption, or in Fixed Investment, or in Investment in Inventories, or in Exports (or some combination). Subtracting that extra $1 billion at the end of the equation then leaves GDP exactly the same.

This is all accounting, or as economists refer to it, national income accounting. Domestic production – GDP – did indeed fall at an annual rate of 0.3% in this initial estimate of GDP for the first quarter of 2025. This was a sharp reduction from the strong and steady growth the country had enjoyed under Biden. The country had nothing close to “3% growth”, as Peter Navarro wrongly asserted.

The figures for GDP and the components of demand that sum to GDP nevertheless acted in highly unusual ways in this first quarter of the Trump administration. The next section of this post will examine those.

C. GDP and Its Demand Components in the First Quarter of 2025

As noted before, the GDP estimates released by the BEA on April 30 are its initial or “advance” estimates of GDP and related figures in the National Income and Product Accounts. Updated estimates based on more complete data will be provided with the second estimate in late May and again with the third estimate in late June. These estimates will likely differ to some degree from these initial estimates.

Historically, the average change in the estimated growth rate of GDP (in percentage points) from BEA’s advance estimate to its second estimate has only been 0.1% points, and also only 0.1% from the advance estimate to the third estimate. But one has to keep in mind that those are changes on average, where sometimes the initial estimates are revised up and sometimes revised down. The very small average difference (only 0.1%) means that there is little bias in the initial estimates historically: they are as often revised up as revised down. In absolute terms (i.e. ignoring whether the revisions were positive or negative), the average change from the advance estimate to the second estimate was 0.5%, and from the advance estimate to the third estimate was 0.7%. Such changes are more significant, and there are even larger changes in periods when, such as now, the economy is going through major disruptions.

Due to the far from normal increase in imports resulting from uncertainty on what tariffs Trump will impose (which appear often to be based on a whim, and announced on social media posts), it is certainly possible and indeed likely that the GDP estimates for 2025Q1 will be revised by more than they normally have in the past. Investment in inventory accumulation is especially difficult to estimate, and may see an especially large revision.

It is therefore quite possible that once revisions to the accounts are made based on more complete data, growth in real GDP will shift from the small negative (-0.3%) in the current estimate to possibly a small positive. This should not, however, be viewed as terribly significant. There is no chance that the revisions will bring growth anywhere close to the almost 3% rates the nation enjoyed under Biden in 2023 and 2024. So while the analysis here has to be based on the figures released in the advance GDP estimates, the basic story should hold as the second and third estimates of GDP are released in the coming months.

This table summarizes the key figures:

Growth in Real GDP and Its Demand Components

| 2025Q1 vs 2024Q4 |

% change |

$ billion change |

| Real GDP |

-0.3% |

-$16.2 |

| Personal Consumption |

1.8% |

$72.4 |

| Gross Fixed Investment |

7.8% |

$80.9 |

| o/w Information Processing Equipment |

69.3% |

$73.6 |

| Investment in Inventories |

|

$131.2 |

| Government Expenditure |

-1.5% |

-$14.6 |

| Federal Government |

-5.1% |

-$19.8 |

| o/w Defense Spending |

-8.0% |

-$18.0 |

| State & Local Government |

0.8% |

$4.9 |

| Exports |

1.8% |

$11.6 |

| Imports |

41.3% |

$333.3 |

|

|

|

| Seasonally adjusted annual rates; 2017 constant$ |

|

|

Starting from the top: Domestic production in real terms (real GDP) fell at an annual rate of 0.3%. In dollar terms (in constant 2017 prices) the fall was $16.2 billion. This change in domestic production was far surpassed by the increase in imports (foreign production) of $333.3 billion in real terms, as individuals and businesses sought to get in front of Trump’s promised tariffs.

Much of the increase in imports likely went into the increase in inventories, which rose by $131.2 billion in real terms. As discussed above, it is not possible to estimate for each of the demand components (the change in inventories being one) how much can be attributed to domestic supplies and how much to imported supplies. It is likely, however, that with such a sizeable jump in imports (41.3% at an annual rate), a substantial share went into inventories.

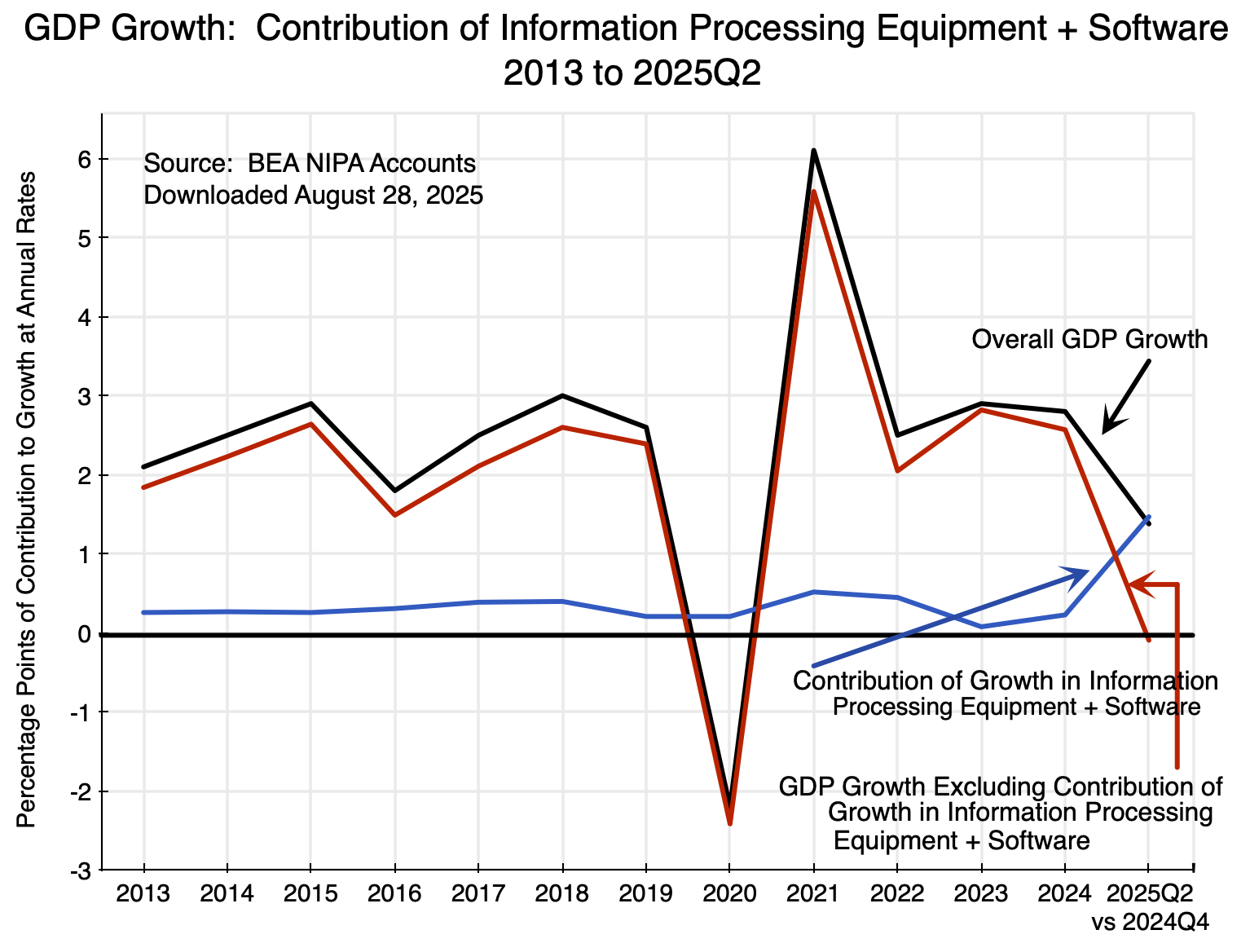

But a significant share of the increase in imported supply was also used directly or indirectly for the final demand components of GDP. As discussed before, each of these reflects the use of a combination of both domestic and imported supplies. Take Gross Fixed Investment, for example. It rose at the very fast rate of 7.8% in annual terms. If one digs into the reported components for this, one will see (in Table 3 of the BEA release) that fixed investment in Information Processing Equipment rose by $73.6 billion in the quarter (69.3% at an annual rate). That one component of investment accounted for over 90% of the overall increase in Gross Fixed Investment in the period (which was $80.9 billion). Investment in Information Processing Equipment had not been booming before: It in fact fell by $10.0 billion in the prior quarter, rose by $21.6 billion in the quarter before that, and rose by $9.7 billion in the quarter before that.

The highly unusual behavior in such investment in the first quarter of 2025 coincided with the uncertainty generated by Trump’s tariffs. And Information Processing Equipment is the type of equipment that firms will often import directly and have installed. It will thus count as part of Gross Fixed Investment in the GDP accounts. Fixed investment rose in the first quarter of 2025, but it is likely that this primarily reflected a rush to import specialized equipment before even higher tariffs (whatever they will be) are imposed by Trump.

There was likely a similar factor that affected the Personal Consumption component, although to a lesser extent than what was seen for Fixed Investment. Personal Consumption rose by 1.8% in real terms at an annual rate. That is not all that high (it rose at a 4.0% rate in the fourth quarter of 2024 – the last quarter of the Biden administration – and by 3.7% in the third quarter of 2024). But at least part of this would have come from businesses and individuals importing items before prices go up due to Trump’s tariffs. Indeed, it is possible – and indeed likely – that net of what was imported to supply this demand (directly or indirectly), the domestic supply for Personal Consumption may well have decreased. As a personal example, my wife and I decided to go ahead and buy now a new Apple iMac computer (which is assembled in China) for our home use. Prices may soon skyrocket. That purchase counted in the Personal Consumption category of the GDP accounts.

It is therefore a mistake to assert, as Trump officials did, that domestic production grew at a healthy rate. The Navarro quote cited above refers to 3% growth, and the White House press release (that Navarro may have helped prepare) similarly says: “Core GDP grew at a robust 3.0%. This signals strong underlying economic momentum that occurred after President Trump’s inauguration.” What they both appear to be referring to is what the BEA calls “Final sales to private domestic purchasers”. It grew at a 3.0% rate. It is defined as the growth in Personal Consumption and in Gross Fixed Investment together. But as just discussed, much and possibly more than all of that growth reflected the surge in imports before tariffs go up. Navarro (and others as well) do not realize that those items in the GDP accounts include imports.

The other items in the demand components of the GDP accounts did not change as much. Federal government expenditures on goods and services (i.e. federal government consumption expenditures and gross investment) fell by $19.8 billion in annual terms (5.1%). But this cannot be attributed to cuts pursued by Elon Musk and his DOGE group. Of the $19.8 billion fall, $18.0 billion was due to a reduction in Defense Spending. That has not been a DOGE focus. Rather, with a change in administrations, decisions on payments and on new procurement contracts are often delayed as the new team comes in.

Finally, a technical note: Some may have noticed that if one adds up the $ changes in the above table for Consumption, Investment, and so on in the well-known GDP equation, the sum comes to a dollar change of -$51.8 billion. This is more than the reported fall of -$16.2 billion. The reason for this difference is that the BEA uses chain-weighted price indices to deflate the nominal estimates of the GDP demand components. (For a discussion of chain-weighted indices, in the context of how the CPI and Personal Consumption Expenditures – PCE – price deflators are calculated, see this earlier post on this blog.)

Chain-weighted price indices are based on weights derived from expenditure shares of individual items in the current period and in the prior one. The BEA uses chain-weighted price indices for all the price deflators it calculates. A property of chain-weighted price indices is, however, that a sum (such as real GDP here) will not necessarily be equal to the sum of the individual components (such as demand components here) in real terms. The sum will in general be close, but the BEA warns readers that they will not be the same.

D. Prospects and Conclusion

In the near term, and as noted above, the BEA will issue its second estimate of the GDP accounts for 2025Q1 in late May and its third estimate in late June. It will then start the quarterly cycle again with its advance estimate of the GDP accounts for 2025Q2 in late July, and so on.

With the major disruptions to the economy due to Trump, there will likely be significant changes in a number of the figures when the second and third GDP estimates are released. The import estimates will likely not be among them (despite the 41.3% jump in the period, or $333.3 billion) as the foreign trade accounts are fairly well known in real time (as imports are recorded as they go through customs). But investment in inventories is much more difficult to estimate. The BEA advance estimate is that they rose by $131.2 billion (in real terms), but I would not be surprised if, in the updated figures based on more complete data reports, inventory accumulation turns out to be higher. If so, then the estimated growth in GDP will be higher. If (purely for the sake of illustration – I am not predicting this), investment in inventories turns out to be $50 billion higher than shown in the advance estimate (i.e. $181.2 billion rather than $131.2 billion), and all else is the same as estimated now, then GDP would have grown at a +0.6% rate rather than fallen at a -0.3% rate.

A change of such a magnitude would not be surprising. GDP growth would still be low, and far below the growth rates achieved when Biden was in office, but possible. But the basic underlying story would remain that businesses urgently brought in imports out of concern (and great uncertainty) about how high tariffs might soon be.

The continued incoherence in Trump’s policies does not augur well for the economy for the rest of the year either. This was demonstrated on April 2 as Trump announced (on what he called “Liberation Day”) his so-called “reciprocal tariffs” at rates as high as 50% (and higher for China). Businesses were in shock, and it took some time before anyone could figure out how Trump’s rates had been set. They were not at all reciprocal, but rather calculated based on the bilateral trade deficit of the US (for goods only, i.e. excluding trade in services) divided by US imports of goods from the country. Trump then backed down a week later, and said he would postpone them for 90 days while a series of deals with countries were negotiated.

Businesses are now basically frozen. They cannot decide on what investments to make – if any – as they cannot know what tariff regime they will be operating in. They have also seen that Trump is more than willing to use the powers of the state to punish companies that upset him, and to take actions that are in blatant violation of the law (knowing that the judicial system takes time to act, and that once it does act they will be faced with a fait accompli). A sound legal system that all must abide by – including a president – is fundamental to any modern economy.

Households are similarly wary. Consumer expectations have plunged, and both the index of consumer sentiment of the University of Michigan and the Consumer Confidence Index of The Conference Board have dropped each and every month of Trump’s term in office from a peak in November/December 2024. It is especially surprising that such indices of consumer sentiment have fallen so much so fast even though the unemployment rate has been steady. Firms are not yet laying off workers, but rather remain basically “frozen”, as they wait for greater clarity on what will happen to the economy. Keeping workers on the payroll while GDP falls means, however, that labor productivity has gone down. One can easily calculate that GDP per worker employed fell at a 1.6% annual rate in 2025Q1. This also puts pressure on costs and hence prices.

On top of this, Trump through Musk and his DOGE team have sought to slash federal government expenditures. The reality is that not much has in fact been cut thus far, but this may soon change. As of May 8, federal government spending in CY2025 was $133.50 billion higher than it was as of the same date in CY2024. The day before Inauguration Day, it was $13.9 billion lower.

But eventually the Trump/Musk/DOGE cuts may materialize. The US economy will then be faced with lower government expenditures, lower private investment as businesses hold back due to the uncertainty, and lower personal consumption spending as households fear what will come next from this administration. All of this is a recipe for a downturn. And once unemployment starts to rise, conditions can quickly deteriorate.

At the same time, Trump’s trade wars are now causing major supply disruptions. Imports from China have basically shut down, and the major US West Coast ports were seeing a steep drop in vessel traffic already in mid-April. There may soon be empty shelves at US stores, which is certainly unlikely to boost consumer confidence. As I write this, the Trump administration has just announced that it is backing down on its confrontation with China, and that it will reduce its tariffs on imports from China to “just” 30% for the next 90 days. But such tariffs are still high and will have a major impact on costs and hence prices.

Along with the other tariffs Trump has imposed (10% on everyone, 25% on steel and aluminum, 25% on autos and auto parts with some exceptions, and a variety of others), costs and hence prices will go up. The Fed may thus not be able to reduce interest rates in response to a downturn. Not much commented on in the recent BEA report was that the Fed’s primary indicator of inflation (the deflator calculated by the BEA for Personal Consumption Expenditures excluding food and energy, i.e. the core PCE deflator) already rose at a 3.5% rate in the first quarter of 2025. This is well above the Fed’s 2.0% target, and was an increase from a 2.6% rate in the last quarter of 2024. The overall PCE deflator rose at a 3.6% rate, and the GDP deflator rose at a 3.7% rate. And this was before the numerous new and/or higher tariffs Trump imposed since the start of April.

An economic recession is thus likely soon. How long it will last will depend on how soon Trump recognizes the harm he has caused to the economy and reverses what he has done. But Trump has never shown much of a willingness to recognize his mistakes, and will certainly never publicly acknowledge that they were mistakes. The possibility of an extended downturn is high.

You must be logged in to post a comment.